1. How to calculate cost of goods sold in excel?

Are you ready to unlock the secrets of calculating COGS in Excel and gain a competitive edge in your business operations? COGS, which stands for Cost of Goods Sold, is a pivotal metric for any enterprise. In this article, we'll guide you through the process of building a comprehensive COGS calculator in Excel. This powerful tool will help you make informed decisions and streamline your financial management. So, let's dive into the world of COGS and discover how to master its calculation!

Understanding COGS

Before we delve into the nitty-gritty of Excel, it's essential to grasp the concept of COGS. Cost of Goods Sold represents the direct costs incurred in producing the goods or services that a company sells during a specific period. Calculating COGS is crucial because it impacts your profitability and overall financial health.

Prerequisites for COGS Calculation

To calculate COGS in Excel, you need to gather some key data. These essential elements include:

1. Beginning Inventory

Your beginning inventory refers to the total value of products or materials your business had on hand at the start of the accounting period. This can include raw materials, work-in-progress items, or finished goods.

2. Purchases During the Period

Purchases during the period encompass all the additional inventory you acquired during the specific accounting period. This may include purchases of raw materials, goods for resale, or other items relevant to your business.

3. Ending Inventory

The ending inventory represents the total value of products or materials you have on hand at the end of the accounting period. This includes any unsold items or materials not used in production.

The COGS Calculation Formula

Now, let's get to the heart of the matter: the COGS calculation formula. In Excel, you can calculate COGS using the following equation:

Cost of Goods Sold = Beginning Inventory + Purchases During the Period - Ending Inventory

It's a straightforward formula, but it can have a profound impact on your financial analysis and decision-making. By plugging in the right numbers, you'll gain a clear picture of your cost of goods sold, helping you manage your finances more effectively.

Excel Implementation

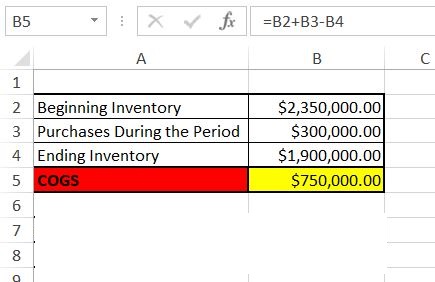

Let's walk through the process of implementing the COGS calculation in Excel. We'll create a simple Excel formula that will do all the work for you. Follow these steps:

-

Open your Excel spreadsheet and enter your data in the following cells:

- Beginning Inventory in cell B2

- Purchases During the Period in cell B3

- Ending Inventory in cell B4

-

In cell B5, paste the COGS formula:

=B2 + B3 - B4

Your COGS calculation is now automated, and you'll see the result in cell B5.

Maximizing ROI with COGS

Understanding COGS is not only about tracking your expenses but also about maximizing your return on investment (ROI). By efficiently managing your cost of goods sold, you can enhance your profitability and ensure your business's long-term success.

In summary, COGS is a critical metric that can significantly impact your financial health and decision-making. By harnessing the power of Excel and using the COGS calculation formula, you can gain better control over your business's finances. Remember, accurate COGS calculation is the key to optimizing your ROI.

So, whether you're a seasoned business owner or just starting out, mastering COGS calculation in Excel is a skill that can set you apart in the competitive world of business. Start implementing these strategies today, and watch your financial management skills soar to new heights!

6. Why should professionals use ACC Law Firm's capital Service?

-

Expertise in Legal Matters: ACC Law Firm specializes in legal services, providing professionals with access to experienced attorneys who can offer valuable legal guidance. Whether it's contract negotiations, intellectual property issues, employment matters, or any other legal concern, their expertise can be invaluable.

-

Tailored Legal Solutions: ACC Law Firm understands that every professional's needs are unique. They can customize their legal services to address the specific challenges and opportunities faced by professionals in different fields.

-

Risk Mitigation: Legal issues can pose significant risks to professionals and their businesses. ACC Law Firm can help identify and mitigate these risks, reducing the potential for costly legal disputes or compliance issues.

-

Resource Optimization: Professionals can save time and resources by outsourcing their legal needs to ACC Law Firm. This allows them to focus on their core competencies and business objectives, while leaving legal matters in the hands of professionals.

-

Access to a Network: ACC Law Firm may have a network of legal experts and professionals in various fields, which can be beneficial for clients seeking connections and advice beyond just legal services.

Q&A

Question 1: What is the cost of goods, and why is it a significant component in financial and business analysis?

Answer 1: The cost of goods, often referred to as the cost of goods sold (COGS), represents the direct expenses associated with producing or purchasing the products or services a business sells. It is a crucial component in financial and business analysis because it directly impacts a company's profitability and provides insights into its operational efficiency.

Question 2: How is the cost of goods sold calculated, and what are the key elements that contribute to its computation?

Answer 2: The cost of goods sold is calculated using the following formula:

Cost of Goods Sold = Opening Inventory + Purchases or Production Costs - Closing Inventory

Key elements that contribute to its computation include:

- Opening Inventory: The value of inventory at the beginning of the accounting period.

- Purchases or Production Costs: The cost of acquiring or producing additional inventory during the accounting period.

- Closing Inventory: The value of inventory at the end of the accounting period.

Question 3: How does the cost of goods sold impact a company's income statement and profitability?

Answer 3: The cost of goods sold is subtracted from a company's revenue on the income statement to calculate gross profit. Gross profit represents the profit generated from a company's core operations before accounting for operating expenses. A high COGS relative to revenue can lead to lower gross profit and reduced profitability, whereas a lower COGS can result in higher gross profit and improved profitability.

Question 4: What are some strategies that businesses employ to manage and reduce their cost of goods sold?

Answer 4: Businesses employ various strategies to manage and reduce their cost of goods sold, including:

- Efficient Supply Chain Management: Streamlining the supply chain, negotiating with suppliers, and optimizing inventory management to reduce procurement and carrying costs.

- Economies of Scale: Expanding operations to benefit from lower per-unit production costs as production volume increases.

- Process Improvement: Implementing lean manufacturing and production techniques to reduce waste and increase efficiency.

- Product and Vendor Selection: Choosing cost-effective materials, suppliers, and components to lower production costs.

- Quality Control: Maintaining quality to reduce defects and rework costs, which can increase COGS.

- Pricing Strategies: Adjusting product pricing to maintain a competitive edge while covering costs and maximizing profit margins.

Effective COGS management is essential for businesses to enhance profitability and maintain competitiveness in the marketplace.

Nội dung bài viết:

Bình luận